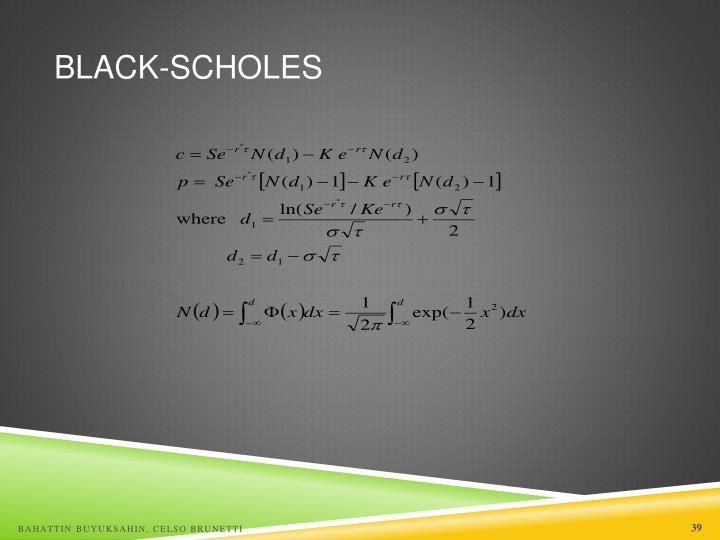

Applying the Black-Scholes formula with these values as the appropriate inputs, e.g.

Note the dividend rate q 1 of the first asset remains the same even with change of pricing. So the original option has become a call option on the first asset (with its numeraire pricing) with a strike of 1 unit of the riskless asset.The payoff of the option, repriced under this change of numeraire, is max(0, S 1(T)/S 2(T) - 1). Under this change of numeraire pricing, the second asset is now a riskless asset and its dividend rate q 2 is the interest rate.First, consider both assets as priced in units of S 2 (this is called 'using S 2 as numeraire') this means that a unit of the first asset now is worth S 1/S 2 units of the second asset, and a unit of the second asset is worth 1.The formula is quickly proven by reducing the situation to one where we can apply the Black-Scholes formula. The model does not require an equivalent risk-neutral probability measure, but an equivalent measure under S 2. In particular, the model does not assume the existence of a riskless asset (such as a zero-coupon bond) or any kind of interest rate. The volatilities of these Brownian motions do not need to be constant, but it is important that the volatility of S 1/S 2, σ, is constant. Margrabe's model of the market assumes only the existence of the two risky assets, whose prices, as usual, are assumed to follow a geometric Brownian motion. If the volatilities of S i 's are σ i, then σ = σ 1 2 + σ 2 2 − 2 σ 1 σ 2 ρ. In other words, its payoff, C(T), is max(0, S 1(T) - S 2(T)). The option, C, that we wish to price gives the buyer the right, but not the obligation, to exchange the second asset for the first at the time of maturity T. Suppose S 1(t) and S 2(t) are the prices of two risky assets at time t, and that each has a constant continuous dividend yield q i. Margrabe's paper has been cited by over 2000 subsequent articles. It was derived by William Margrabe (PhD Chicago) in 1978. In mathematical finance, Margrabe's formula is an option pricing formula applicable to an option to exchange one risky asset for another risky asset at maturity.

0 kommentar(er)

0 kommentar(er)